Client management system for a UK-based financial advisory company

Industry

Fintech

Location

UK

Platform

Web

Cooperation

1+ years

About the project

Our client, SKYNEXE, is a UK-based company that partners with numerous financial advisory organizations, including Prydis Wealth and P1 Investment Services — entities specializing in guiding high-net-worth individuals through investment decisions, financial planning, and wealth management services. To enable scalability and expansion, the company needed a Client Management System that would onboarding clients, digitize operations and streamline data collection and processing.

Challenge

Before our engagement, our client gathered information primarily via email threads and PDF forms. The approach was serviceable but not tech-driven: staff re-keyed details from messages and attachments into multiple systems to create a consistent dataset. This fragmented toolset, spanning emails, calls, and documents, made onboarding new financial-advice clients slow, inconsistent, and hard to manage. Their objective was to consolidate these steps into a single digital workflow that centralizes data capture and streamlines onboarding.

To address this challenge, SKYNEXE required a dual-application platform to centralize all client data in one place. This meant creating two separate but fully synchronized tools – one for advisers and one for clients. Advisers required a Microsoft-based application that could align with the company’s reliance on Microsoft platforms and integrate with existing licenses and tools. At the same time, clients needed a user-friendly interface to easily access and interact with their data in real time.

A critical requirement was ensuring that any update, whether made by advisers or clients, would appear instantly in both applications. Meeting this requirement demanded extensive synchronization capabilities to guarantee accuracy and consistency across the platform.

The solution had to provide the following functionality:

- Replace manual, initial client data collection with a fast, user-friendly, and secure digital process.

- Allow users to update their data whenever needed to ensure that the client information stays current.

- Secure management of client data to comply with regulation and risk management.

- Operate within the Microsoft ecosystem — the industry-standard technology stack for UK-based financial institutions — so data stays compatible with existing systems and meets industry requirements.

- Serve both internal advisers and external clients via intuitive, role-specific interfaces.

- Handle millions of sensitive financial records quickly, securely, and with full traceability.

- Expand over time into a complete Client Management System with planning, reporting, and lifecycle management features.

Solution

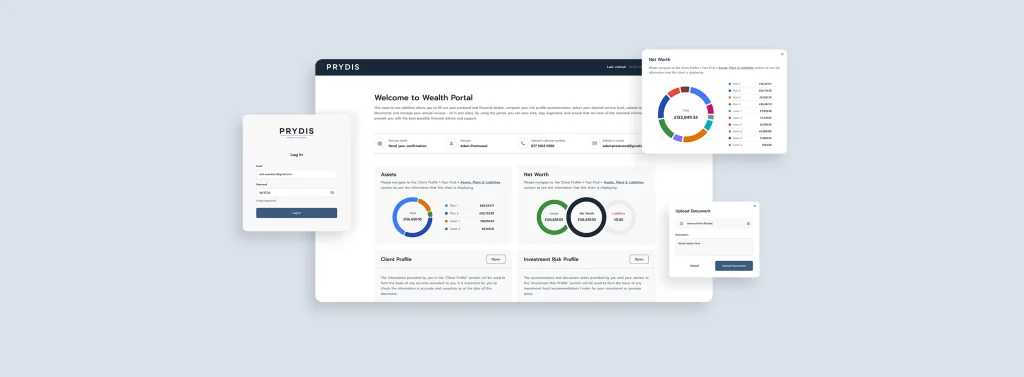

To meet the requirements, we designed and implemented Client Management System — a dual-application system, backed by the Microsoft ecosystem.

- Wealth Pilot: A model-driven app for financial advisers, built within Microsoft Power Apps and fully integrated with Dataverse, Power Automate, and SharePoint.

- Wealth Portal: A client-facing app developed using Blazor with a shared .NET backend. This combination ensures consistent functionality across platforms and provides an interactive, visually rich UI for clients to input and manage their data.

The two apps communicate in real time, allowing both clients and advisors to operate on the same synchronized dataset without any redundancy or delay. Both advisers and clients have instant visibility into the onboarding process and data updates, which minimizes manual rework and improves data integrity across all operations.

As the platform matured, the need for a more scalable solution with advanced architecture emerged. At the same time, demand for such solutions in the financial advisory sector was steadily rising. Our client’s case attracted interest from other companies seeking a digital solution for wealth management. In response to these factors, SKYNEXE decided to transform the system into a SaaS product.

As part of this ambition, additional capabilities were delivered, including automated document generation, annual reviews, the possibility for other firms to add personalized branding elements, and many others. This functionality was introduced through new app features.

Features

Automated document generation

Users can apply document templates to automatically create regulatory and reporting documents, such as annual review letters and suitability letters, directly from client data, without manual formatting.

Automated risk reporting

With Power BI integration provides advanced analytics and enables the generation of risk assessment reports from client profiles, ensuring FCA compliance and helping advisors understand client risks and needs.

Advanced KYC and risk profiling

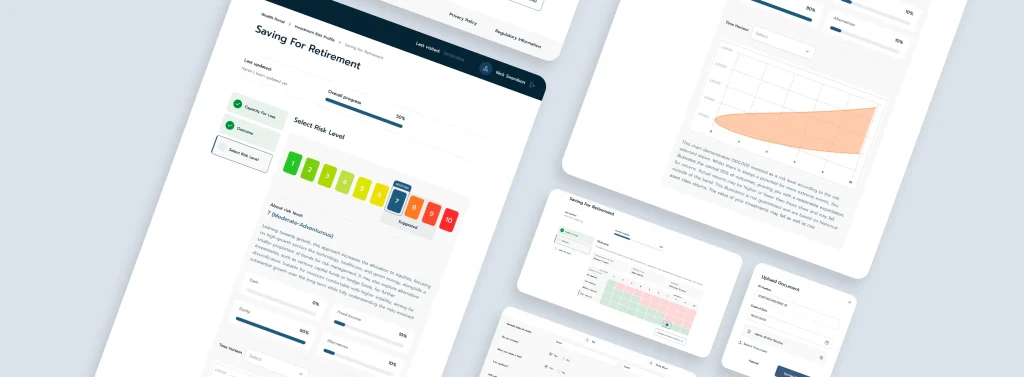

Clients complete structured questionnaires that generate risk groupings, charts, and compliance data on the fly, with downloadable risk reports to Microsoft Word.

Investment forecasting and scenario modelling

Advisors simulate future financial scenarios using cash flow modelling and variable assumptions (retirement age, fund performance, etc.).

Excel exports for analytics teams

Advisors and operational staff can export filtered client segments for targeted outreach or performance monitoring.

Customizable branding per organization

Each partner company has complete control over UI themes, logos, and interface language for easy white-label deployment.

Enterprise-grade permissions and audit trails

All platform actions are logged, role-restricted, and traceable to meet security and compliance requirements.

Automated notifications and alerts

System alerts notify both clients and advisors of required actions, document status, or changes in account data.

Real-time bi-directional synchronization

Live data sync between three systems — Client UI, Advisor Portal, and current data platform — ensures consistency and continuity.

Technologies

PowerApps

Power Automate

SharePoint

Dataverse

.NET

Blazor

React

Azure

Azure Functions

Azure Cloud

Azure Resources

Auth0

Business value

The introduction of this Client Management System became a significant digital transformation milestone for SKYNEXE and a major operational advancement for its partners. Designed from the ground up as a scalable, fully integrated SaaS platform, it transformed the way clients are onboarded, managed, and supported throughout the advisory cycle. What began as a small onboarding tool has grown into a robust CRM system that centralizes operations, ensures compliance, and enhances both client and advisor experience.

Key delivered benefits include:

- Streamlined onboarding: Replacing manual processes (emails, messages, and calls) with a structured, automated digital flow

- Centralized data management: All client records, documents, and historical information are accessible from a single source of truth

- Improved efficiency: Live data sync and dynamic document generation that reduces manual workload and error risk

- High scalability: Supports dozens of independent partner organizations with customizable branding and configuration

- Regulatory compliance: Built-in modules for risk profiling, KYC validation, and automated report generation

- Operational continuity: Real-time alerts, incident tracking, and monitoring ensure system reliability post-rollout

- Client-centric UX: Enhanced transparency, faster interactions, and intuitive UI that elevates client satisfaction

- Future-ready architecture: Designed for continuous evolution, the platform supports future modules such as AI-powered analysis from Teams call transcripts

By aligning technology with the real business needs, the platform has become a critical asset in SKYNEXE’s service offering. In just one year of operation, Wealth Pilot has onboarded over 20 financial organizations, managed 2200 active clients, and processed more than 25 million records. The platform delivers real-time data management, ensures that compliance requirements are met, supports multi-brand environments, and has received consistently positive feedback from users across roles and organizations.

Contact us

Daryna Chorna

Customer success manager