We use cookies to ensure we give you the best experience on our website. By clicking Agree you accept our Privacy and Cookies Policy.

Solution for seamless share calculations and distribution

Industry

Fintech

Location

Canada

Platform

Web

Cooperation

2+ years

About the project

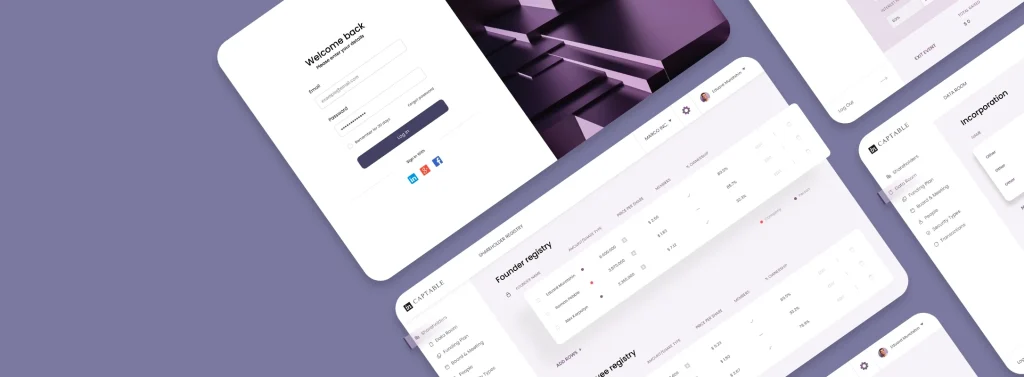

Our team developed a platform called CapTable for managing employee stock plans and venture capital. The software helps private enterprises in distributing equity among founders, staff members and third parties.

It may be used by startups and early-stage ventures to seamlessly handle employee share allocations and simplify stock arrangements. CapTable offers businesses all the tools necessary to ensure data privacy and law compliance.

Challenge

Typically, investors request capitalization tables when planning fundraising rounds for a startup. In essence, this is a list or spreadsheet that provides a summary of all the shareholders that have an interest in a new company.

While the simplest scenario is the straightforward round-by-round share allocation to founders and investors, in reality, deal structures are more complicated. The allocation of equity shares deviates from voting rights and from money proceeds (e.g. after a trade sale or an IPO). Therefore, startups need to hire external consultants and lawyers to reproduce the contractually fixed distribution, which is expensive and time-consuming.

To make share distribution easier, we were challenged to create a tool that could make appropriate calculations on the CapTable platform. The hard part was to make this calculator function based on given contract agreements.

Solutions

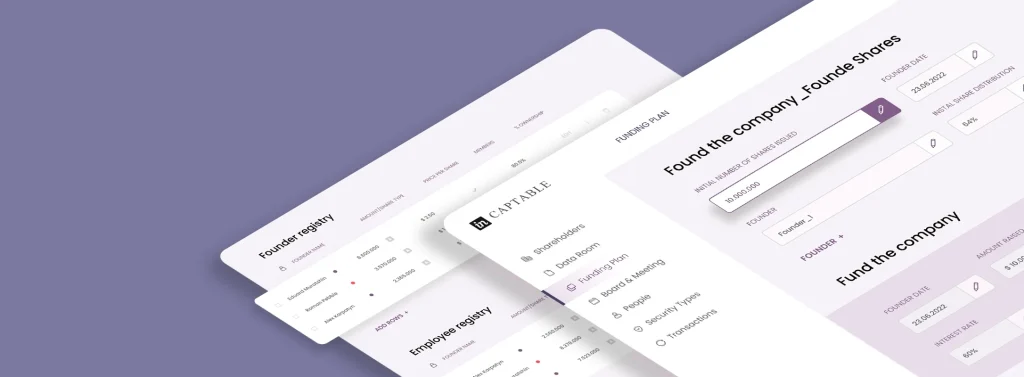

We’ve developed a platform that helps startup owners to effortlessly manage shares and employee equity schemes. CapTable lists company’s shares and provides information on who owns them. It also shows each investor’s percentage of ownership in the company and the value of their securities.

Once a user logs into their account, they can see the amount of their shares as well as the price per share and its class. CapTable has both a founder registry and employee registry.

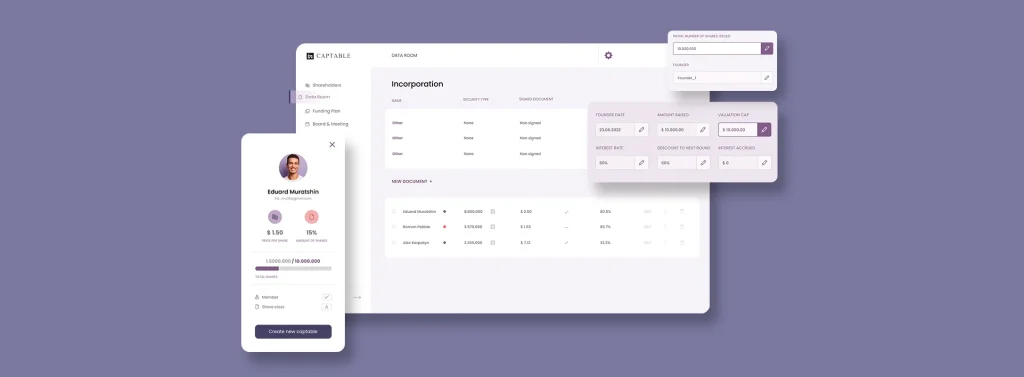

In the data room, shareholders can check the status and security type of their agreements. The data room page also displays whether each document was already signed or not.

In addition, CapTable helps to create a funding plan that involves the following information: a founding date, the amount of money raised, valuation cap, the number of shares issued and the price per share as well as an interest rate, discount for the next round and the amount of interest accrued.

This page displays each seed round with all the information separately.

The funding plan contains data about founders’ and employees’ shares. For each category, it includes:

- Founder or employee names

- Initial share distribution (%)

- Distribution after dilution

- Number of shares

On the Board & Meetings page, users can find the documents added to the software each month. The name of the person who shared the document and the date are also displayed. Users can edit and delete documents on this page.

The page called List of People allows users to see the status of invitations sent to shareholders. If the invitation hasn’t been accepted, there is a button to resend it.

In the Security Types section, the number of shares for each class type is displayed. Each class is accompanied with the amount of capital committed, price per share and liquidation preference.

CapTable also displays all the transactions made through the software. Each transaction in the list comes with the date, its type, share price and type, % of shares as well as total price and the name of a person who conducted it.

Features

CapTable has a range of helpful features listed below

- The list of a company’s shareholders

- Data room with document storage

- A detailed funding plan with round descriptions

- Document sharing

- The ability to send invitations and track their status

- Share classification based on security types

- Transaction history

Technologies

ASP.NET

React

Business value

Capitalization tables are usually created before other corporate documents in the first stages of a startup. After a few rounds of financing, the cap tables become complex since they contain a lot of information and require extensive calculations. To reduce complexity, newly-launched ventures can use CapTable.

This platform stores all the information about company equity and allows for automatic share calculations. This way, it helps to save money and time spent on consulting financial experts. What’s more, CapTable enables automatic legal validation for share distribution, which is also cost- and time-efficient.

Contact us

Daryna Chorna

Customer success manager